washington county utah sales tax

The average cumulative sales tax rate in Washington Utah is 675. Sales Tax Breakdown Washington Details Washington UT is in Washington County.

Minnesota Bill Of Sale Form For Ibm Storage Equipment Download The Free Printable Basic Bill Of Sale Blank Form Template In Minnesota Bill Of Sale Template Ibm

RFP for CMGC Services for new Washington County Purgatory Medical Unit Housing Expansion with Remodel Town Hall Discussion Proves to be Valuable and Collaborative Jul Treasurer 197 East Tabernacle St.

. Washington County UT Sales Tax Rate The current total local sales tax rate in Washington County UT is 6450. Washington UT Sales Tax Rate The current total local sales tax rate in Washington UT is 6750. 696 Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335.

145 lower than the maximum sales tax in UT The 675 sales tax rate in Washington consists of 485 Utah state sales tax 035 Washington County sales tax 1 Washington tax and 055 Special tax. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Washington County UT at tax lien auctions or online distressed asset sales. Utah is ranked 1131st of the 3143 counties in the United States in order of the median amount of property taxes collected.

87 North 200 East STE 201. They also state that the average combined. The County Assessor is responsible for listing and valuing all taxable real and personal property in Washington County.

Washington is in the following zip codes. Did South Dakota v. The Utah sales tax rate is currently.

The County sales tax rate is. As far as other cities towns and locations go the place with the highest sales tax rate is Springdale and the place with the lowest sales tax rate is Central. This sale will be located in.

Tax Sale Full List Details Published in the Spectrum April 25 May 2 9 16 2021. The sales tax jurisdiction name is Washington City which may refer to a local government division. Washington County collects on average 051 of a propertys assessed fair market value as property tax.

Some cities and local governments in Washington County collect additional local sales taxes which can. 93 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Washington is located within Washington County Utah.

The Washington sales tax rate is. Provide copy of your Utah State License. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

This webpage has been moved here. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes. What is the sales tax rate in Washington Utah.

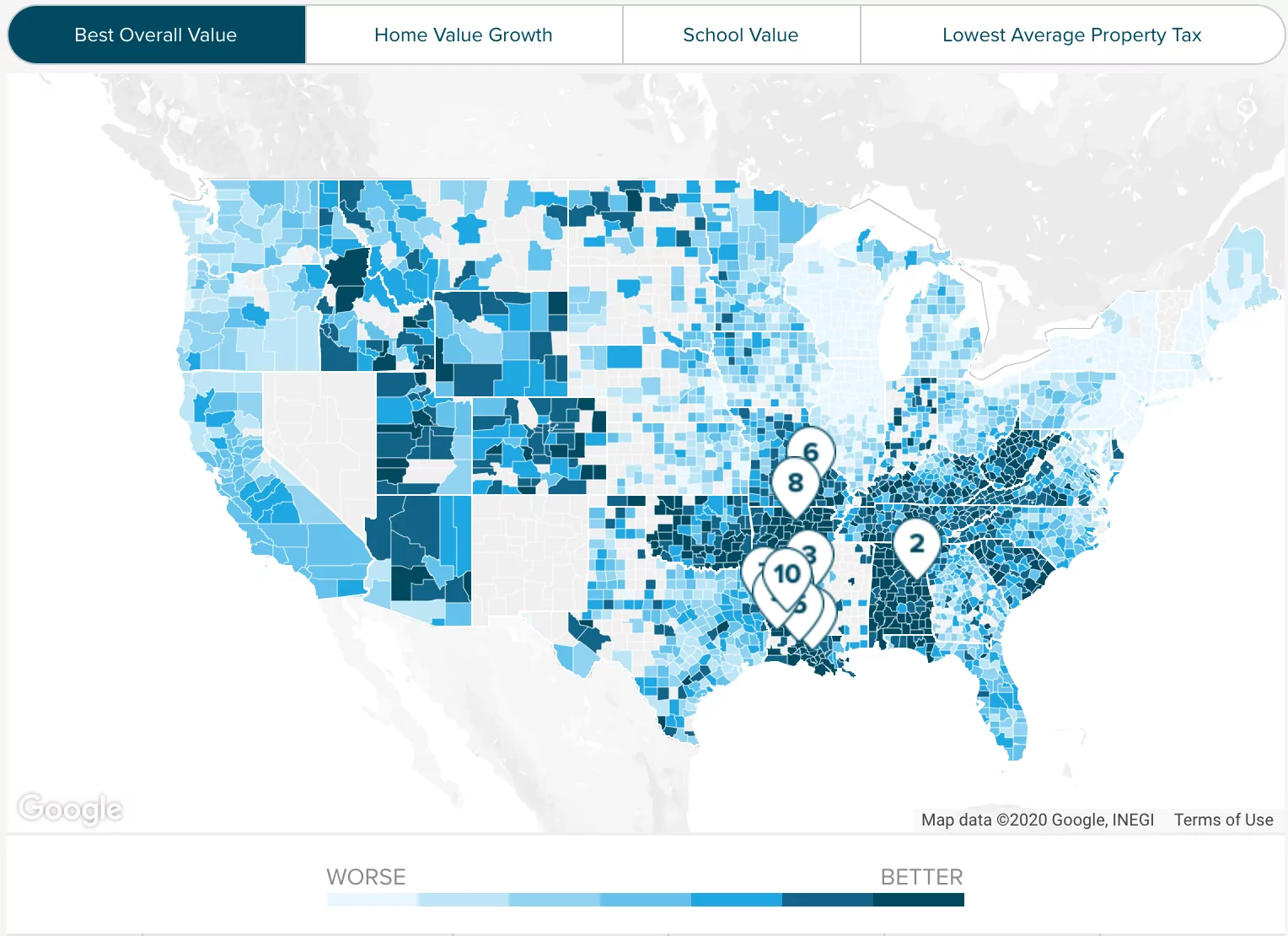

How Does Sales Tax in Washington County compare to the rest of Utah. The one with the highest sales tax rate is 84767 and the one with the lowest sales tax rate is 84722. Washington County in Utah has a tax rate of 605 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Washington County totaling 01.

Sales Tax Breakdown Sales Tax Rates. Please update your bookmarks accordingly. The Washington County Utah sales tax is 605 consisting of 470 Utah state sales tax and 135 Washington County local sales taxesThe local sales tax consists of a 135 county sales tax.

Property Tax Estimate NOTE. There are a total of 127 local tax jurisdictions across the state collecting an average local tax of 211. Or the local number for the Utah State Tax Commission is 435 251-9520.

The Washington County Sales Tax is 16 A county-wide sales tax rate of 16 is applicable to localities in Washington County in addition to the 485 Utah sales tax. Wayfair Inc affect Utah. The median property tax in Washington County Utah is 1231 per year for a home worth the median value of 240900.

George UT 84770 Phone. Washington County UT currently has 228 tax liens available as of August 1. The December 2020 total local sales tax rate was also 6450.

The minimum combined 2022 sales tax rate for Washington Utah is. You can print a 675 sales tax table here. The Washington County Sales Tax is collected by the merchant on all qualifying sales made within Washington County.

See corporationsutahgov for more information. The December 2020 total local sales tax rate was also 6750. This is the total of state county and city sales tax rates.

Sales Tax Number if items are sold. The sales tax rate does not vary based on zip code. You can find more tax rates and allowances for Washington County and Utah in the 2022 Utah Tax Tables.

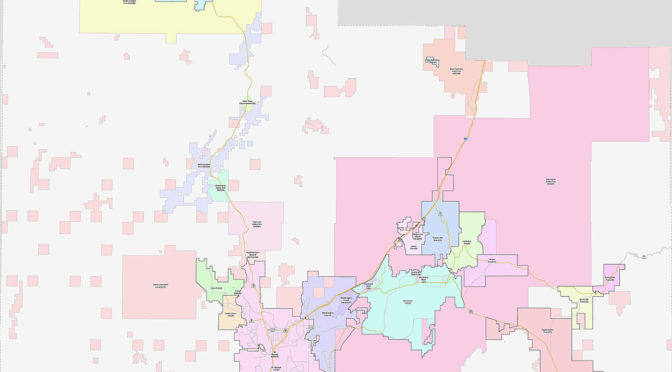

The most populous zip code in Washington County Utah is 84790. Within Washington there is 1 zip code with the most populous zip code being 84780. Click here for a larger sales tax map or here for a sales tax table.

These buyers bid for an interest rate on the taxes owed and the right to. This includes the sales tax rates on the state county city and special levels. Washington County Administration Building 197 East Tabernacle St George Utah Google Maps Auctions will be by open bidding wherein the full parcel will be sold to the highest dollar bidder.

Assessor Tom Durrant 87 North 200 East STE 201 St. According to Sales Tax States 61 of Utahs 255 cities or 23922 percent charge a city sales tax. Washington County Justice Court 87 N 200 E 301 3rd Floor St George.

How Do State And Local Sales Taxes Work Tax Policy Center

How To Calculate Sales Tax For Your Online Store

How Do State And Local Sales Taxes Work Tax Policy Center

Where Are Americans The Happiest Vivid Maps American History Timeline Map America Map

Public Notices Washington County Of Utah

Utah Sales Tax Small Business Guide Truic

West Seattle Route West Seattle Alki Beach Seattle Seattle Map

Utah Sales Tax Rates By City County 2022

Pennsylvania Sales Tax Guide For Businesses

Sales Tax On Grocery Items Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Ranking State And Local Sales Taxes Tax Foundation

How To Charge Your Customers The Correct Sales Tax Rates

Washington County Or Property Tax Calculator Smartasset

Arive Homes Utah County Home Builder Homes For Sale Utah County 3 Car Gargage Craftsman House Plans Ranch Style House Plans Small Ranch Style House Plans